Lineage Financial Group

License NPN# 10370901

Insurance for you them: More than a policy. An act of love.

Easy and affordable non-medical plans.

One-on-one guidance to help you protect what you have while growing more

Working with us means never having to make financial decisions alone. We connect you with an agent in your community–someone who understands your needs and priorities. Together, you’ll find the right approach to protect your family and help them prosper.

Financial expertise, human connection

We have agents all around the country, and you can choose the one who’ll be dedicated to addressing your unique needs

Comprehensive, customized solutions

We offer best-in-class products and solutions that adapt to your changing needs to help grow your financial security and your peace of mind

A commitment to doing what’s right

Through many challenges, we stand by our policy owners, committed to diversity, responsibility, and exceptional service. These values define us.

What Our Agents Do for You

Lineage Financial Group Insurance agents:

Ask the right questions to give you personalized service

Find cost-friendly coverage that never decreases

Value-hunt by looking for policy discounts

Are licensed to help you understand your policies

Are local businesspeople who serve your community

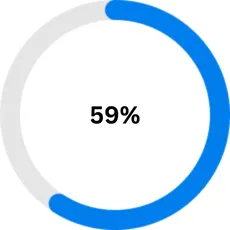

… of people who don’t own life insurance say they need it.

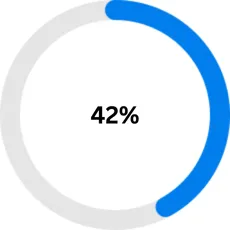

… of Americans would face financial hardship within 6 months if the primary wage-earner were to die unexpectedly.

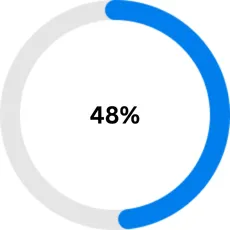

… say they are more likely to buy via simplified underwriting.

Testimonials

"I’m grateful I found you. The process was incredibly simple, and now I have peace of mind knowing that my daughter is protected."

- Isaiah R.

"There’s nothing more reassuring than knowing my kids won’t face financial difficulties. Although it will be tough emotionally, having this coverage in place means they’ll have one less worry."

- Olivia M.

"When I began looking for burial insurance, it was overwhelming. But they really had my best interests at heart and made the process much easier."

- Laura W.

Term Life Insurance

Term life insurance provides coverage for a predetermined amount of time, typically between 1-35 years. Death benefit will payout if the policy owner passes away within the term of the policy.

Cost effective option for young growing families or individuals looking for more affordable coverage.

There is no guarantee of renewal when the term ends; however, certain term policies may allow for an option to renew.

Return-Of-Premium Term

We offer a compelling Return of Premium (ROP) term insurance policy which returns all contributed premiums if the insured outlives the term period.

Premium returns can start as early as the second year.

Life insurance protection in place if needed and return of premium investments if not.

Indexed Universal Life Insurance

Indexed Universal Life (IUL) is a permanent policy similar to a traditional UL policy through its flexibility of premium and death benefit; however, it also features a higher growth potential through index interest crediting. The policy owner has the ability to choose a percentage of the cash value to invest within specified “indexes” (such as the S&P 500 or Nasdaq 100) to increase the chances of larger returns.

No-Medical-Exam Life Insurance

This simple, affordable life insurance is designed to cover expenses like medical bills and funeral costs (including plot and mortuary expenses) and can help protect your loved ones from future financial burdens. This provides permanent life insurance coverage with flexibility and long-term grown potential.

Up to $250,000 death benefit.

No medical exam or blood work is required.

Fixed Indexed Annuity

With Fixed Indexed Annuities, premiums are tied to an index and credited in a similar fashion to IULs. As with IULs, Fixed Indexed Annuities offer principal protection and a death benefit, with the possibility for gains contingent upon market performance.

A type of tax-deferred insurance product.

Can be structured to provide income for life, acting as another resource for retirement income.

Provides protection from market decline with a guaranteed floor.

Our Driven Community of #LegacyCreators

Our Trusted Partners

Here's my

INVITATION

Let's set aside 15 minutes to discuss the following:

Key questions or concerns you have.

What is the right coverage for you

The best company that will cover you

The best way to save on your policy

The truth about those $9.99 plans

The difference between insurances

Jose Lopez

NPN #: 10370901

Licensed In: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Luisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi , Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New México, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregón, Pensilvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Virginia Occidental, Wisconsin, Wyoming, Pennsylvania